- #Bank of america incoming international wire transfer fee how to#

- #Bank of america incoming international wire transfer fee code#

- #Bank of america incoming international wire transfer fee free#

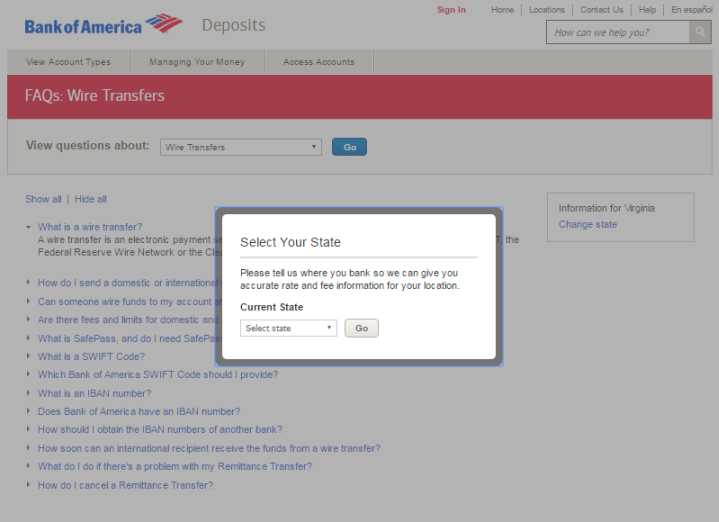

Sign Up for a Debit Card with No Wire Transfer FeesĪt Cheese, we’re dedicated to ensuring that our users pay $0 in monthly fees while enjoying other zero-fee perks such as no overdraft fees, no international wire fees, and no minimum balance fee. So, unless you have cash from someone else, you might not even need to bring the physical money with you because it’ll already be in your account.Ĭontact BOA customer service to find out the bank’s operating hours and to potentially set up an appointment to avoid waiting in line. To initiate a transfer with BOA, you have to have an Bank of America account. All you have to do is head to your nearest Bank of America branch with the information and cash in hand. It’s possible to initiate a BOA wire transfer offline. At the top of the screen that follows, you’ll have to select the table that says “Send Money” and then choose whether it’s going to your own account, another account, or a business. If you are going to initiate a wire transfer online through Bank of America, you simply need to first log in to Bank of America Online Banking.

#Bank of america incoming international wire transfer fee how to#

How to Send Wire Transfers Through Bank of America How to Send BOA Wire Transfers Online Here is a helpful guide on how to find your ABA and routing number with BOA. Routing numbers and the beneficiary BOA account number can all be found by accessing your BOA bank account online.

If you’re transferring money to an account in Europe that does use IBAN, you can usually find it by visiting their website or asking the recipient for the number. The US doesn’t currently participate in IBAN, which means no American bank will provide you with an IBAN code.

#Bank of america incoming international wire transfer fee code#

Some wire transfers might ask for an IBAN, which is a set of numbers that create a code for transfer in Europe.

Bank of America address for incoming wires in foreign currency:.  Bank of America address for incoming wires in US dollars:. Bank of America SWIFT code for incoming wires in foreign currency: BOFAUS6S. Bank of America SWIFT code for incoming wires in US dollars: BOFAUS3N. In terms of policies and other things to know about Bank of America wire transfers, you’ll likely need to know certain information to complete the transfer, such as the bank’s SWIFT code, bank address, and more. There are no limits to how much money you can receive through Zelle. If you’ve decided to use Zelle (as mentioned above, it’s integrated into the BOA online banking system for account users), the transfer limit is currently $2,500 per day or $20,000 per month, depending on the bank limits you have for your specific account. But, ACH transfer limits are currently set to $3,000 per day or $6,000 per month for standard delivery. In general, it depends on the type of account you have. There are transfer limits with most banks. Wire Transfer Policies and Limits at Bank of AmericaĪre there wire transfer limits at Bank of America? You bet. Again, the ability to complete a transfer via Zelle or any other money transfer app depends on the bank of the recipient, how much you’re sending, and where the bank is located.

Bank of America address for incoming wires in US dollars:. Bank of America SWIFT code for incoming wires in foreign currency: BOFAUS6S. Bank of America SWIFT code for incoming wires in US dollars: BOFAUS3N. In terms of policies and other things to know about Bank of America wire transfers, you’ll likely need to know certain information to complete the transfer, such as the bank’s SWIFT code, bank address, and more. There are no limits to how much money you can receive through Zelle. If you’ve decided to use Zelle (as mentioned above, it’s integrated into the BOA online banking system for account users), the transfer limit is currently $2,500 per day or $20,000 per month, depending on the bank limits you have for your specific account. But, ACH transfer limits are currently set to $3,000 per day or $6,000 per month for standard delivery. In general, it depends on the type of account you have. There are transfer limits with most banks. Wire Transfer Policies and Limits at Bank of AmericaĪre there wire transfer limits at Bank of America? You bet. Again, the ability to complete a transfer via Zelle or any other money transfer app depends on the bank of the recipient, how much you’re sending, and where the bank is located. #Bank of america incoming international wire transfer fee free#

It’s free for most users (depending on the bank of the recipient) and is a great alternative to a traditional wire transfer. However, it’s important to note that you can also transfer money with your Bank of America account by using Zelle, a money transfer app that’s integrated into the BOA online banking system.

Outgoing domestic wire transfer fees are $30 per transaction. Incoming domestic wire transfer fees are $15 per transaction. Want to make a BOA wire transfer to another account within the United States? It’s possible, and easy, especially if the recipient also has a bank account with Bank of America. Dollar fees are $45 per transactionĭomestic Wire Transfer Fees at Bank of America BoA outgoing foreign wire transfers sent in U.S. BoA outgoing foreign wire transfer sent in foreign currency fees are $35 per transaction. BoA incoming foreign wire transfers are $16 per transaction. The BOA international wire transfer fee is: Like every other major bank, initiating or receiving a Bank of Ameria wire transfer incurs a fee. International Wire Transfer Fees at Bank of America And, there are almost always fees involved, both for incoming and outgoing transfers both internationally and domestically. Or, it can be done through a third-party money transfer service such as Western Union. Depending on the banks that both the sender and the recipient use, it’s possible to initiate a wire transfer via the bank itself. To complete this transfer, you usually need the name of the recipient, their bank name, account number, and pickup details.

0 kommentar(er)

0 kommentar(er)